Below, we'll share a few of the most fascinating Minnesota chauffeur stats for the previous pair of years. There were 364 MN driving fatalities in 2019, 4% less than in 2018. Out of the 364 deaths: Men are most likely to be included in vehicle collisions, and that doesn't come as a shock as there are much more male motorists than women chauffeurs.

Therefore, you need to constantly understand your environments when driving and also not use your phone behind the wheel. insurance. Filing an SR-22 insurance coverage certificate in Minnesota isn't as difficult as it may appear. All you need to do is get in touch with your insurance policy provider and educate them of your web traffic offense.

You will receive an SR-22 certification within a month. Evidence of insurance policy need to be carried at all times, particularly when law enforcement requests it, when you're renewing your vehicle enrollment, or when the car is involved in an accident.

This period might differ relying on the extent of the infraction. Some chauffeurs require it just for a year, yet others may have to bring it for the entire three years until it's not called for any longer - insurance. An SR-22 filing is when your insurance carrier submits the SR22 kind on your behalf with the Minnesota Division of Public Safety And Security, Division of Lorry Providers.

This policy is an excellent choice for individuals that require proof of insurance, even if they do not drive often or own a vehicle. It's additionally great for those who drive leased autos or automobiles of their family members as well as good friends. Most Inexpensive Business for SR22 Insurance in Minnesota, There are several options readily available to drivers trying to find SR22 insurance policy in Minnesota.

If you're a risky vehicle driver with numerous traffic infractions on your driving document, you will certainly require to connect with your insurance coverage provider to submit for an SR-22 in Minnesota. If you're buying SR22 insurance policy in Minnesota, you will certainly need to contrast rates and also find the choice that ideal fits your requirements.

Not known Factual Statements About How A Dui Or Dwi Can Affect Your Car Insurance - Investopedia

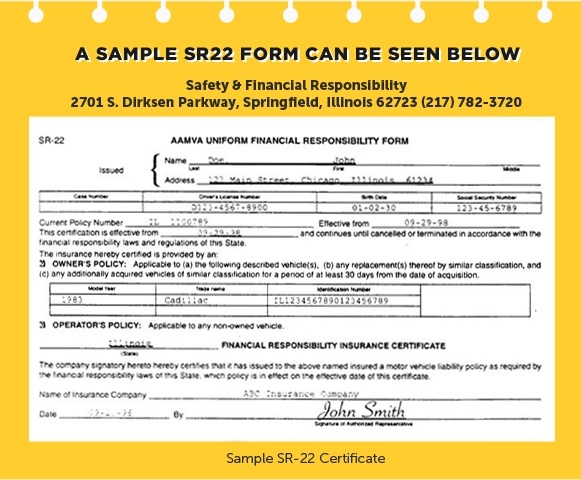

It's a type filed by your insurance provider that guarantees your vehicle insurance protection complies with the state minimum obligation requirements. Exactly How Can I Get an SR-22 Certificate in Minnesota? If you're aiming to get an SR-22 certification in Minnesota, you will certainly need to request your insurance policy provider for one.

That Has the Least Expensive SR-22 Insurance Coverage in Minnesota? The company that supplies the least expensive SR-22 insurance policy in Minnesota is State Ranch.

Which states require SR-22s? Each state has its very own SR-22 protection demands for vehicle drivers, and all undergo change. Connect with your insurance policy supplier to figure out your state's current requirements and also make certain you have appropriate protection. How much time do you require an SR-22? Most states require vehicle drivers to have an SR-22to confirm they have insurancefor about 3 years.

SR22 Insurance policy expense will differ by state. No matter what some companies inform you, there is generally a fee to submit an SR22. An Austin SR22 insurance price with Progressive consists of a $25 filing cost per insurance coverage term plus a surcharge. The expenses are built into your insurance policy in the kind of surcharges (sr-22 insurance).

Car insurance policy companies will normally bill a nominal fee of $15 to $25 for submitting an SR-22 type. If you need an SR-22, however, you'll initially require to buy a car insurance plan - division of motor vehicles. Aspects that usually enter into score a plan will establish your vehicle insurance rates. Furthermore, there might be a surcharge as long as you have the declaring on your insurance coverage.

We can offer an SR22 declaring for any kind of state that needs to release your permit for getting a Texas certificate. An Austin SR22 cost is your insurance policy plus the SR22 filing fee - auto insurance. You can buy SR22 Insurance coverage in Austin with Austin Insurance Coverage Group for any state in the country. The majority of people refer to SR22 as SR22 insurance policy.

How Long Does Dui Affect Insurance In California? for Dummies

You do not also have to do it yourself, we will submit it for you. The declaring fee is an one-time fee that you will require to pay when the insurer files the SR-22.

Along with the filing cost and also any type of additional charges, all of it boils down to the reason that you were called for to have an evidence of economic responsibility to begin with. Most of the time, its as a result of among the following: driving intoxicated driving without insurance creating an accident continuously commuting website traffic infractions Those incidents take place your driving record, as well as all of the insurer have accessibility to it - dui.

Having to submit SR22 Kind indicates you will be in a team. Fortunately is that this is just momentary - auto insurance. You ought to talk to the neighborhood authorities to learn how much time you need to carry SR22 insurance coverage and if the minimal responsibility limitations have actually been satisfied.

You must contrast quotes from a minimum of 3 different insurance provider. You can save a lot of time and also money by letting us contrast your rates with every one of the companies that we stand for. Austin Insurance Group stands for more than 15 various firms that provide Austin SR22 protection in Texas.

If you are billed with a DRUNK DRIVING, you might require to file type SR-22 via your car insurance company. Those that aren't familiar with this kind sometimes assume it is an automobile insurance plan, however that isn't rather proper.

If you have a squeaky-clean driving document, don't worryonly those that have been charged with specific offenses have to submit an SR-22. An SR-22 is not an insurance plan.

5 Easy Facts About California Sr-22 Car Insurance (With Quotes) - Insurify Shown

Farmers as well as Progressive have the most affordable prices country wide for chauffeurs requiring an SR-22. What is an SR-22? If you have actually never ever become aware of an SR-22, you possibly do not require one; they are just called for when vehicle drivers deal with particular convictions. That usually implies a DUI, moving violation, or reckless driving. Yet stick around, since there are whole lots of various other infractions that could lead to the requirement for an SR-22, which we'll cover quickly.

That is the only method to obtain an SR-22; if you are without insurance, you'll have to resolve that. Who needs an SR-22? Not everyone requires an SR-22. If you have no infractions on your driving document, you won't need to stress over this kind in any way. Yet if you have ever had a significant violation, there is a great chance you'll have to let your state recognize you are still insured.

As usual, you can expect to pay a $25 one-time fee to submit an SR-22. You likewise have to pay the charge if you permit your plan to gap and the SR-22 needs to be re-filed. Plus, a filing charge is charged for every individual SR-22 filed. If you and also your partner need SR-22s, you'll pay the charge twice, Worters claims.

Just what you need: an additional charge. On the plus side, this is a single cost you will not have to pay once more. You may be asking yourself just just how much premiums typically raise when you file an SR-22. Once more, there is a lot of variant. Guarantee. com's analysis discovered that the ordinary boost is 89%.

That holding true, there is no collection costs increase for those that need SR-22 insurance. Where you stay in enhancement to your driving record and also the kind of vehicle you drive all impact the rise you'll see in your prices - vehicle insurance. Obviously, infractions that indicate risky habits, such as a DUI, imply your price rise will be steeper.

Sadly, the solution to the inquiry of rate rises will certainly never be the very same for everyone. You will need an individualized SR-22 insurance quote to really recognize what type of rise you are facing. SR-22 insurance policy rates by business Nobody likes when their automobile insurance rates increase, however that will likely hold true if you need an SR-22 - credit score.

The Greatest Guide To How Much Does Sr-22 Insurance Raise Premiums In California?

Just how do you know your insurance company will submit the type? As it ends up, some insurance companies can not be bothered to do this. Likewise, many car insurer don't want the hassle of declaring SR22s with states as well as likewise filing SR-26s when policies gap, says Alex Hageli, director of personal lines plan with the Residential property Casualty Insurers Organization America, a market trade group.

The FR-44 must remain in result for three years, which is the very same as the SR-22 in many states. Regularly asked inquiries Exactly how much does SR22 insurance coverage cost a month?

com. Prices vary, however you can anticipate a rise in your month-to-month insurance coverage premiums if you have to submit an SR-22 (motor vehicle safety). What does SR 22 insurance cover? In several states, this is only responsibility defense; some states call for higher degrees of protection. Naturally, you can choose for even more insurance coverage, but if you need an SR-22, there is a certain degree of coverage that will be needed.

If you satisfy the minimal requirements for your state, congrats: your insurance company will certainly submit an SR-22 to allow the state recognize. The SR-22 stays in impact for 3 the 5 years, depending on your state. Ask your insurer if you aren't certain how much time the SR-22 will certainly be in impact.

If you are mentioned for anything besides the most small of occurrences, such as littering from a car, call your insurance policy service provider. They file the kind and will certainly understand if one is required for you. What does SR 22 mean? SR represent and. Why is SR 22 insurance coverage so expensive? If you've been needed to file an SR-22, it generally means you are taken into consideration a risky vehicle driver.

The riskier you are, the higher your car insurance policy rates will certainly be. Exactly how can I prevent submitting an SR 22? The only way to stay clear of submitting an SR-22 in a state that needs the kind is to avoid web traffic offenses and also sentences that result in the demand for the form.

Not known Details About How Much Does Austin Sr22 Insurance Cost?

If you are founded guilty of Drunk driving your insurance policy business will likely raise your costs. The method DUI influences insurance policy is complicated, and it won't constantly impact your prices.

If you get a DUI and you still have 11 months left on your policy, your price is fixed for those 11 months. They're complimentary to price estimate the new rate at a higher rate.

Like the SR-22, the FR-44 also reveals evidence of monetary responsibility, yet it has higher liability restrictions (vehicle insurance). The FR-44 should continue to be in effect for 3 years, which is the exact same as the SR-22 in many states. Regularly asked questions Just how much does SR22 insurance policy set you back a month? A plan in addition to one DUI sentence has an ordinary expense of around.

com. insurance. Prices differ, but you can expect a rise in your monthly insurance coverage costs if you need to submit an SR-22. What does SR 22 insurance policy cover? In several states, this is just responsibility defense; some states call for higher levels of protection. Certainly, you can opt for more insurance coverage, however if you need an SR-22, there is a particular level of insurance coverage that will certainly be required.

If you fulfill the minimal demands for your state, congrats: your insurer will certainly submit an SR-22 to allow the state recognize. The SR-22 continues to be basically for 3 the 5 years, relying on your state. Ask your insurance provider if you aren't sure the length of time the SR-22 will be in result. bureau of motor vehicles.

If you are pointed out for anything various other than the most minor of events, such as littering from a lorry, call your insurance company. Why is SR 22 insurance coverage so pricey? If you have actually been called for to file an SR-22, it usually indicates you are considered a high-risk driver (auto insurance).

Indicators on How Long Does A Dwi Negatively Affect Your Car Insurance ... You Should Know

The riskier you are, the greater your automobile insurance coverage prices will be. Exactly how can I stay clear of filing an SR 22? The only method to avoid filing an SR-22 in a state that needs the form is to stay clear of website traffic infractions and convictions that result in the need for the type.

If you are founded guilty of DUI your insurance coverage firm will likely elevate your premium. sr22 insurance. The way DUI affects insurance policy is complicated, and it won't constantly impact your prices.

So if you obtain a DUI and also you still have 11 months left on your plan, your rate is dealt with for those 11 months. The only exemption is if you use for brand-new coverage. After that they're complimentary to estimate the brand-new price at a greater rate. Thus, if in all possible it's finest not to look for brand-new insurance coverage up until your present policy runs out.